Having a good credit score is crucial for a healthy financial life. It influences everything from securing loans and mortgages to getting approved for credit cards and even renting an apartment. A high credit score unlocks better interest rates, lower monthly payments, and even access to exclusive rewards. However, building a strong credit score takes time and effort. If you’re struggling with your credit, don’t worry! There are several effective strategies you can implement to improve your score and achieve your financial goals.

This article will guide you through practical ways to improve your credit score. We’ll explore simple yet impactful strategies, including paying your bills on time, reducing your credit utilization ratio, and building a positive credit history. Discover how to understand your credit report, identify areas for improvement, and navigate the world of credit scores with confidence. Let’s embark on this journey together and unlock the benefits of a strong credit profile.

Understanding Credit Scores and Their Importance

A credit score is a numerical representation of your creditworthiness, which is a measure of your ability to repay borrowed money responsibly. It plays a crucial role in various financial aspects of your life, impacting your access to loans, credit cards, insurance rates, and even job opportunities.

Here’s a breakdown of what constitutes a credit score:

- Payment History: This is the most significant factor, accounting for 35% of your score. It reflects your track record of making timely payments on your credit obligations.

- Amounts Owed: This factor (30%) represents the amount of debt you currently hold relative to your available credit limits. It’s about how much credit you’re using compared to how much you have available.

- Length of Credit History: This factor (15%) reflects the age of your credit accounts and the average length of time you’ve had them. A longer history generally indicates a more responsible credit usage.

- Credit Mix: This factor (10%) considers the types of credit you have, such as credit cards, installment loans, and mortgages. A diverse mix of credit accounts can positively influence your score.

- New Credit: This factor (10%) assesses how often you apply for new credit. Frequent applications can temporarily lower your score, as it indicates potential risk to lenders.

The Importance of a Good Credit Score:

A good credit score opens doors to various financial benefits, including:

- Lower Interest Rates on Loans: A higher credit score typically translates to lower interest rates on mortgages, auto loans, and personal loans, saving you thousands of dollars over the loan term.

- Easier Approval for Credit Cards: A good credit score makes you a more attractive borrower, increasing your chances of approval for credit cards with favorable terms, such as lower fees and higher credit limits.

- Competitive Insurance Rates: Some insurance companies consider credit scores as an indicator of risk. A good score can lead to lower premiums for auto insurance, homeowners insurance, and even life insurance.

- Potential Job Opportunities: In certain industries, employers may conduct credit checks as part of the hiring process. A strong credit score can demonstrate financial responsibility and trustworthiness, giving you an edge over other candidates.

Maintaining a Healthy Credit Score:

Building and maintaining a good credit score is essential for a secure financial future. Here are some key strategies:

- Pay Your Bills on Time: This is the most crucial factor in determining your credit score. Set reminders or automate payments to ensure timely payments.

- Keep Your Credit Utilization Low: Aim to keep your credit utilization ratio (amount of credit used vs. available credit) below 30%.

- Don’t Apply for Too Much Credit: Frequent credit applications can lower your score, so only apply when necessary.

- Monitor Your Credit Report Regularly: Review your credit report at least once a year for errors or fraudulent activity. You can access your report for free from the three major credit bureaus: Equifax, Experian, and TransUnion.

- Consider a Secured Credit Card: If you’re struggling to build credit, a secured credit card can be a good option. You’ll need to make a security deposit, which serves as collateral for the credit line.

Understanding and maintaining a healthy credit score is fundamental to achieving financial well-being. By following these tips, you can pave the way for a brighter financial future.

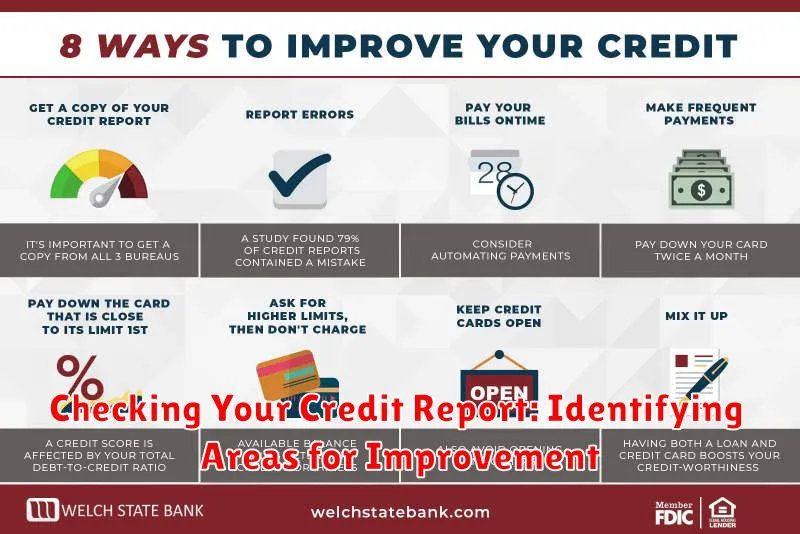

Checking Your Credit Report: Identifying Areas for Improvement

Your credit report is a detailed record of your financial history, reflecting your borrowing and repayment habits. It plays a crucial role in determining your creditworthiness, impacting your ability to secure loans, credit cards, mortgages, and even rental agreements. Regularly checking your credit report is essential for ensuring its accuracy and identifying potential areas for improvement.

Understanding Your Credit Report

Credit reports typically contain information about your:

- Personal information: Name, address, Social Security number.

- Credit accounts: Credit cards, loans, mortgages, and other lines of credit.

- Payment history: Whether you have made payments on time or have missed payments.

- Credit inquiries: When lenders or other companies have checked your credit report.

- Public records: Information about bankruptcies, liens, and judgments.

How to Access Your Credit Report

You are entitled to receive a free copy of your credit report from each of the three major credit reporting agencies: Equifax, Experian, and TransUnion, once a year through AnnualCreditReport.com. You can also obtain your report directly from the credit reporting agencies for a fee.

Reviewing Your Credit Report

Once you receive your credit report, carefully review it for any inaccuracies. Look for:

- Incorrect personal information: Ensure your name, address, and other details are accurate.

- Unrecognized accounts: Verify that all listed accounts are yours and you recognize them.

- Late or missed payments: Check if any payments are marked as late or missed, especially if you made them on time.

- Negative information: Investigate any negative entries, such as bankruptcies or liens, to understand their reason and ensure their accuracy.

Improving Your Credit Score

If you find errors or areas for improvement on your credit report, you can take steps to address them:

- Dispute inaccuracies: Contact the credit reporting agency and submit a dispute for any incorrect information.

- Pay down debt: Reduce your debt-to-credit ratio by paying down outstanding balances.

- Make timely payments: Ensure you make all payments on time to avoid late fees and negative marks on your credit report.

- Limit new credit applications: Excessive credit inquiries can negatively impact your score.

- Consider a secured credit card: A secured credit card can help you build credit if you have limited credit history.

Conclusion

Checking your credit report is an essential step in maintaining a healthy financial life. By understanding your credit report and taking steps to improve it, you can strengthen your creditworthiness, access better financial products, and potentially save money on interest rates.

Paying Bills on Time: Establishing a Positive Payment History

Building a good credit score is essential for financial well-being. A strong credit score opens doors to lower interest rates on loans, better insurance rates, and even better job opportunities. One of the most significant factors contributing to your credit score is your payment history. Paying your bills on time consistently demonstrates your financial responsibility and helps build a positive credit history.

Here’s why paying bills on time is crucial:

- Improved Credit Score: Timely payments make up a significant portion of your credit score. The longer you consistently pay on time, the higher your score is likely to be.

- Lower Interest Rates: A good credit score earns you lower interest rates on loans, credit cards, and mortgages. This translates to significant savings over the life of the loan.

- Easier Approval for Credit: When you apply for credit, lenders look at your credit history. A positive payment history increases your chances of getting approved.

- Increased Financial Opportunities: A strong credit score can open doors to better job opportunities, lower security deposits, and even better car insurance rates.

- Peace of Mind: Knowing you have a good credit history brings peace of mind. You won’t have to worry about late fees, penalties, or credit score damage.

Here are some tips for establishing and maintaining a positive payment history:

- Set Reminders: Utilize online bill pay, calendar reminders, or mobile apps to stay on top of your due dates.

- Automate Payments: Consider setting up automatic payments for recurring bills, eliminating the risk of forgetting.

- Stay Organized: Keep track of all your bills, due dates, and payment amounts in a dedicated system.

- Pay More Than the Minimum: Whenever possible, pay more than the minimum due to reduce your overall debt faster.

- Review Your Credit Report Regularly: Check your credit report at least annually to ensure accuracy and identify any potential errors.

Building a positive payment history takes time and effort, but it’s a worthwhile endeavor. By establishing and maintaining responsible payment habits, you’ll pave the way for a brighter financial future.

Managing Credit Card Balances: Maintaining a Low Credit Utilization Ratio

Credit card balances can be a source of stress and financial strain if not managed effectively. One of the most important factors in maintaining good credit health is keeping a low credit utilization ratio (CUR). This ratio represents the percentage of your available credit that you’re currently using.

Let’s break down why this ratio matters and how you can keep yours in check:

Why is Credit Utilization Ratio Important?

Credit utilization is one of the key factors considered by credit bureaus when calculating your credit score. A high credit utilization ratio can negatively impact your score, potentially leading to higher interest rates on loans or difficulty securing new credit.

Here’s why:

- Lenders view it as a risk factor. A high CUR suggests you may be overextended financially, increasing the likelihood of defaulting on your payments.

- It can reflect irresponsible spending habits. Lenders may interpret a high CUR as a sign of poor financial management.

What is a Healthy Credit Utilization Ratio?

Aim for a credit utilization ratio of 30% or less. Ideally, you should strive for a ratio below 10% for optimal credit health.

How to Improve Your Credit Utilization Ratio

There are several strategies you can implement to lower your credit utilization ratio:

- Pay down your balances. Make more than the minimum payment due on your credit cards to reduce your outstanding balances more quickly.

- Avoid opening new credit accounts. Each new account lowers your available credit, potentially increasing your credit utilization.

- Request a credit limit increase. If you have a good credit history, consider requesting a credit limit increase from your card issuers. This can help lower your credit utilization ratio, even if your balances remain the same.

- Consider balance transfers. If you have high-interest debt, consider transferring balances to a card with a lower introductory APR.

- Use credit responsibly. Avoid using credit cards for unnecessary purchases, and try to pay off your balance in full each month to keep your utilization at zero.

Monitoring Your Credit Utilization

Regularly check your credit reports from all three major credit bureaus (Experian, Equifax, and TransUnion) for free at AnnualCreditReport.com. This will allow you to monitor your credit utilization and identify any potential issues.

Conclusion

Maintaining a low credit utilization ratio is a crucial step in managing your credit card balances effectively and building a strong credit score. By understanding the importance of this metric and implementing the strategies outlined above, you can improve your credit health and achieve your financial goals.

Becoming an Authorized User on a Responsible Account

An authorized user is someone who is added to a credit card account by the primary cardholder. They are allowed to use the card but are not legally responsible for the debt. This can be a good way to help someone build credit or to make it easier to share expenses.

However, it is important to be aware of the potential risks of becoming an authorized user. If the primary cardholder is irresponsible with their spending, it could negatively impact the authorized user’s credit score. Additionally, the authorized user may be liable for charges if they use the card without the primary cardholder’s permission.

Here are some things to consider before becoming an authorized user:

The Benefits

There are several benefits to becoming an authorized user on a credit card account:

- Building Credit: This can be especially helpful for individuals who are just starting to build credit. If the primary cardholder has a good credit history, the authorized user can benefit from it.

- Easier Sharing of Expenses: It can simplify things if you need to share expenses with someone, such as a family member or roommate.

- Access to Rewards: Some credit cards offer rewards programs, and authorized users can often participate in them.

The Risks

It’s important to be aware of the potential risks associated with becoming an authorized user:

- Negative Impact on Credit: If the primary cardholder is irresponsible with their spending, it could negatively impact the authorized user’s credit score. This is because the authorized user’s credit history will be tied to the primary cardholder’s.

- Liability for Charges: While authorized users are not legally responsible for the debt, they may be liable for charges if they use the card without the primary cardholder’s permission.

- Limited Control: Authorized users do not have control over the account and cannot change the terms or conditions of the card.

Important Considerations

Before becoming an authorized user, you should discuss these questions with the primary cardholder:

- What is the primary cardholder’s credit history like?

- Are there any limits or restrictions on how you can use the card?

- How will you be notified of charges made on the card?

- What happens if the primary cardholder defaults on the debt?

Conclusion

Becoming an authorized user on a credit card account can be a good way to build credit or make it easier to share expenses, but it’s important to be aware of the risks involved. If you are considering becoming an authorized user, it’s crucial to have a clear understanding of the terms and conditions of the account and to communicate openly with the primary cardholder. By doing so, you can make an informed decision about whether or not becoming an authorized user is right for you.

Avoiding Unnecessary Credit Applications: Protecting Your Credit Score

Your credit score is a crucial factor in securing loans, mortgages, and even rental agreements. It’s a reflection of your financial responsibility, and a healthy score opens doors to better interest rates and financial opportunities. However, many factors can impact your credit score, and one of the most overlooked is the act of applying for credit.

Every time you apply for a credit card, loan, or even a new utility account that requires a credit check, a “hard inquiry” is placed on your credit report. Hard inquiries can temporarily lower your credit score, especially if you have a limited credit history. While occasional inquiries are inevitable, unnecessary applications can significantly impact your score, potentially affecting your financial future.

Here’s how to avoid unnecessary credit applications and safeguard your credit score:

1. Pre-Qualify Before Applying

Many lenders offer pre-qualification options, which allow you to see if you’re likely to be approved for a loan or credit card without impacting your score. These pre-qualification checks are considered “soft inquiries” and don’t show up on your credit report. Take advantage of this feature to gauge your eligibility before submitting a formal application.

2. Shop Around Wisely

When you’re in the market for a loan or credit card, don’t just settle for the first offer you receive. Shop around and compare terms from multiple lenders. You can often get better interest rates or rewards by comparing options. Remember to keep all your inquiries within a short period, typically within 14-45 days, so they are treated as a single inquiry. This approach minimizes the impact on your credit score.

3. Avoid Multiple Applications at Once

Submitting a flurry of applications in a short span can drastically lower your score, even if you’re ultimately approved for only one or two. It’s better to space out your applications to avoid overwhelming your credit history.

4. Be Mindful of Auto-Renewal Options

Many credit cards and loans have automatic renewal options, which can lead to unnecessary hard inquiries if you forget to opt out. Regularly review your accounts and ensure that you’re not being charged for services you don’t need or want.

5. Stay Organized

Keep track of all your credit applications and credit inquiries. This will help you avoid duplicate applications and ensure you’re not inadvertently impacting your credit score.

By understanding the impact of credit applications and practicing these strategies, you can avoid unnecessary hits to your credit score, protecting your financial well-being and paving the way for a brighter financial future.

Disputing Errors on Your Credit Report: Correcting Inaccuracies

Your credit report is a crucial document that lenders use to assess your creditworthiness. It contains information about your borrowing history, including loans, credit cards, and other financial obligations. Inaccuracies on your credit report can negatively impact your credit score and make it difficult to obtain loans, mortgages, or even rent an apartment. It’s essential to regularly review your credit report and dispute any errors you find.

Understanding Your Credit Report

Your credit report is compiled by three major credit reporting agencies: Equifax, Experian, and TransUnion. Each agency maintains a separate report, and there can be discrepancies between them. It’s essential to check all three reports to ensure accuracy. You can obtain a free copy of your credit report from each agency once a year through AnnualCreditReport.com.

Common Errors to Watch For

Several common errors can appear on your credit report, including:

- Incorrect personal information: This includes mistakes in your name, address, Social Security number, or date of birth.

- Accounts that don’t belong to you: Sometimes accounts belonging to someone else with a similar name might be mistakenly included on your report.

- Incorrect account balances or payment history: Errors in the amount you owe or your payment history can negatively affect your credit score.

- Late payments that were actually made on time: If a payment was received on time but reported as late, you should dispute it.

- Closed accounts that are still listed as open: Closed accounts should not affect your credit score, so any inaccuracies should be corrected.

How to Dispute Errors

Once you’ve identified an error on your credit report, you need to file a dispute with the credit reporting agency. You can typically do this online, by mail, or by phone. The credit bureau must investigate your dispute and correct any errors within 30 days. If the agency doesn’t find the error or cannot verify its accuracy, they must remove it from your report.

When disputing an error, be sure to include the following:

- Your name, address, and Social Security number.

- The specific error you’re disputing.

- The credit reporting agency you’re contacting.

- Supporting documentation, such as copies of payment receipts or statements.

Maintaining Accuracy

Disputing errors on your credit report can be a tedious process, but it’s crucial for maintaining accurate credit information. Regularly reviewing your credit report and correcting inaccuracies can help protect your credit score and ensure you have access to fair financial products and services. Remember to check your report at least once a year and be proactive in resolving any issues.

Building a Positive Credit History: Time and Consistency

A strong credit history is essential for financial well-being. It impacts your ability to secure loans, credit cards, and even rental agreements. Building a positive credit history takes time and consistency, but it is a worthwhile investment in your future.

Start Early and Be Consistent

The earlier you start building credit, the better. If you’re a young adult, consider getting a secured credit card or becoming an authorized user on a parent’s or guardian’s credit card. This will allow you to start establishing a credit history.

Consistency is key. Make sure to make all your payments on time, whether it’s for your credit card, loan, or utility bills. Late payments can negatively impact your credit score, so it’s crucial to prioritize timely payments.

Use Credit Wisely

Avoid using too much of your available credit. Your credit utilization ratio, which is the amount of credit you’re using compared to your total credit limit, can significantly affect your credit score. Aim to keep your utilization ratio below 30%.

Avoid opening too many credit accounts at once. Every time you apply for credit, a hard inquiry is made on your credit report. Too many hard inquiries can lower your score.

Monitor Your Credit Regularly

It’s crucial to monitor your credit report regularly for any errors or fraudulent activity. You are entitled to a free credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) every 12 months.

Dispute Errors

If you find any errors on your credit report, dispute them with the respective credit bureau immediately.

Conclusion

Building a positive credit history is a long-term process that requires patience, consistency, and responsible financial behavior. By starting early, using credit wisely, and monitoring your report regularly, you can establish a strong credit foundation that will benefit you for years to come.

Seeking Professional Credit Counseling if Needed

If you’re struggling with debt, you’re not alone. In fact, millions of Americans are facing financial hardship, and it can be overwhelming to know where to turn for help. Fortunately, there are resources available, and one of the most effective is professional credit counseling. Credit counseling can help you understand your finances, create a budget, and develop a plan to get out of debt.

It’s important to note that not all credit counseling services are created equal. Some are legitimate and reputable, while others may be scams. It’s crucial to do your research and choose a credit counseling agency that is certified by a reputable organization such as the National Foundation for Credit Counseling (NFCC) or the American Association of Debt and Credit Counselors (AADCC).

Here are some of the benefits of seeking professional credit counseling:

- Financial Education: Credit counselors can provide valuable insights into financial management principles, budgeting techniques, and debt management strategies.

- Debt Consolidation: They can help you consolidate multiple debts into a single loan with a lower interest rate, making it easier to manage and repay.

- Debt Management Plans (DMPs): Credit counselors can negotiate with creditors on your behalf to lower interest rates, reduce monthly payments, or even eliminate certain debts.

- Financial Counseling: Credit counselors offer personalized support and guidance to help you develop a financial plan that works for your individual circumstances.

If you’re considering seeking professional credit counseling, be sure to choose a reputable agency and ask about their fees and services. Credit counseling is a valuable resource that can help you regain control of your finances and get back on track.